Understanding Intrinsic Value and Margin of Safety: The Cornerstones of Value Investing

This article explores intrinsic value and its crucial relationship with margin of safety. These two concepts, central to Benjamin Graham's The Intelligent Investor, form the foundation of value investing.

What is Intrinsic Value?

Intrinsic value, also known as fundamental value, represents the true worth of an investment based on its projected future cash flows, growth potential, and inherent risk. Think of it as discounting all future cash flows back to their present value.

While the definition is straightforward, calculating intrinsic value is inherently imprecise. Hundreds of variables influence this estimate, making pinpoint accuracy nearly impossible. We'll address how to navigate this uncertainty shortly.

Intrinsic Value vs. Market Value: The "Mr. Market" Difference

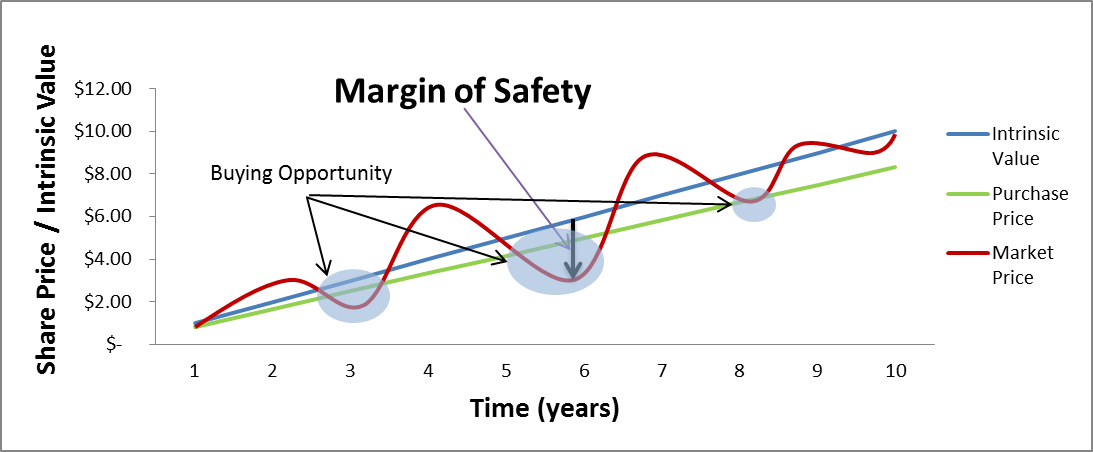

It's crucial to understand that intrinsic value can differ significantly from the current market value or price. Market price reflects the price at which you can buy or sell an asset, influenced by various factors, including investor sentiment and short-term market fluctuations (the fickle "Mr. Market"). This often results in assets trading substantially above or below their true worth.

Intrinsic Value vs. Book Value: Beyond the Balance Sheet

Book value, an accounting measure, represents a company's value based on its balance sheet (assets minus liabilities). While it can sometimes approximate intrinsic value, accounting rules often fail to capture intangible assets, making book value an unreliable indicator of true worth.

Risk: The Discount Rate and Margin of Safety

Risk plays a dual role in your investment decisions:

- Discount Rate: It influences the rate at which you discount future cash flows back to their present value. This is your required rate of return, factoring in your cost of capital and inflation.

- Margin of Safety: It dictates the necessary buffer between the estimated intrinsic value and your purchase price. Investments with higher uncertainty demand a larger margin of safety.

The Purpose of Estimating Intrinsic Value: Exploiting Mispricings

As Howard Marks aptly stated, inefficient markets provide "the raw materials — mispricings." The goal of estimating intrinsic value is to capitalize on these mispricings.

- Market Value < Intrinsic Value: A potential buying opportunity.

- Market Value > Intrinsic Value: A reason to avoid or sell the asset.

Margin of Safety: Your Discount for Uncertainty

The margin of safety is the discount below intrinsic value that you, as an investor, require before buying. Value investors seek assets with the largest margin of safety – those trading far below their estimated intrinsic value.

Why is Intrinsic Value Difficult to Calculate?

Calculating intrinsic value is more challenging for some assets than others. Bonds, with their fixed cash flows and duration, are relatively easier to value than stocks.

Stocks, however, have numerous tangible and intangible variables affecting future cash flows, growth, and risk. While financial statements provide insights into tangible assets, they often fail to capture the true value of intangibles like:

- Proprietary technology

- Trademarks and patents

- Brand strength

- Research and development

- Management quality

- Competitive advantages

These intangibles often create the largest discrepancies between intrinsic, market, and book values.

Embrace Uncertainty: Focus on the Variables

Don't be discouraged by the difficulty in pinpointing intrinsic value. It's not an exact science! Instead of fixating on a single number, focus on understanding the key variables that influence your estimate. As Warren Buffett suggests, build a bridge capable of carrying 30,000 pounds, but only drive 10,000-pound trucks across it.

These variables will guide your assessment of the required margin of safety.

The Margin of Safety: Your Key to Success

Echoing Joel Greenblatt, "The secret to investing is to figure out the value of something – and then pay a lot less."

After estimating a reasonable range for intrinsic value, demand a sufficient margin of safety to account for unforeseen problems and potential errors in your analysis. A wider range for your intrinsic value estimate necessitates a larger margin of safety.

- High Uncertainty + Small Margin of Safety = High Risk

- Low Uncertainty + Large Margin of Safety = Low Risk

A Different Perspective on Risk

Seek investments where the perceived risk is higher than the actual risk. This often translates to a price lower than the true value. Avoid situations where perceived risk is lower than the real risk, as this often indicates an overvalued asset.

Ultimately, a sufficient margin of safety minimizes risk! The best risk/reward opportunities arise from buying assets well below their intrinsic value.

In Conclusion: Value is What You Get

Remember Warren Buffett's wisdom: "Price is what you pay. Value is what you get." By diligently estimating intrinsic value and demanding a sufficient margin of safety, you can position yourself for long-term investment success.